How Do You Calculate Loss Ratio In Insurance . Loss ratio is an important metric. it is calculated as the ratio of incurred losses (including claims paid, loss reserves, and loss adjustment expenses) to the earned. it is a metric that specifically measures the profitability of insurance companies. Loss ratio = ((insurance claims paid + loss adjustment. What is an acceptable loss ratio? the formula to calculate the insurance loss ratio (ilr) is straightforward and is given by: with this loss ratio calculator, we are here to help you calculate and insurance company's underwriting loss ratio. the loss ratio is calculated as losses incurred in claims (paid to the insured for damages when the risk event happens) plus adjustment expenses. How do you calculate a loss ratio? by using the formula for loss ratio calculation, insurance companies can gain insights into their financial performance, identify. the loss ratio should be used in conjunction with the expense ratio to determine the company’s profitability. \ [ ilr = \frac {d} {p} \times.

from insurancetrainingcenter.com

it is calculated as the ratio of incurred losses (including claims paid, loss reserves, and loss adjustment expenses) to the earned. What is an acceptable loss ratio? \ [ ilr = \frac {d} {p} \times. it is a metric that specifically measures the profitability of insurance companies. Loss ratio = ((insurance claims paid + loss adjustment. with this loss ratio calculator, we are here to help you calculate and insurance company's underwriting loss ratio. the formula to calculate the insurance loss ratio (ilr) is straightforward and is given by: by using the formula for loss ratio calculation, insurance companies can gain insights into their financial performance, identify. the loss ratio should be used in conjunction with the expense ratio to determine the company’s profitability. How do you calculate a loss ratio?

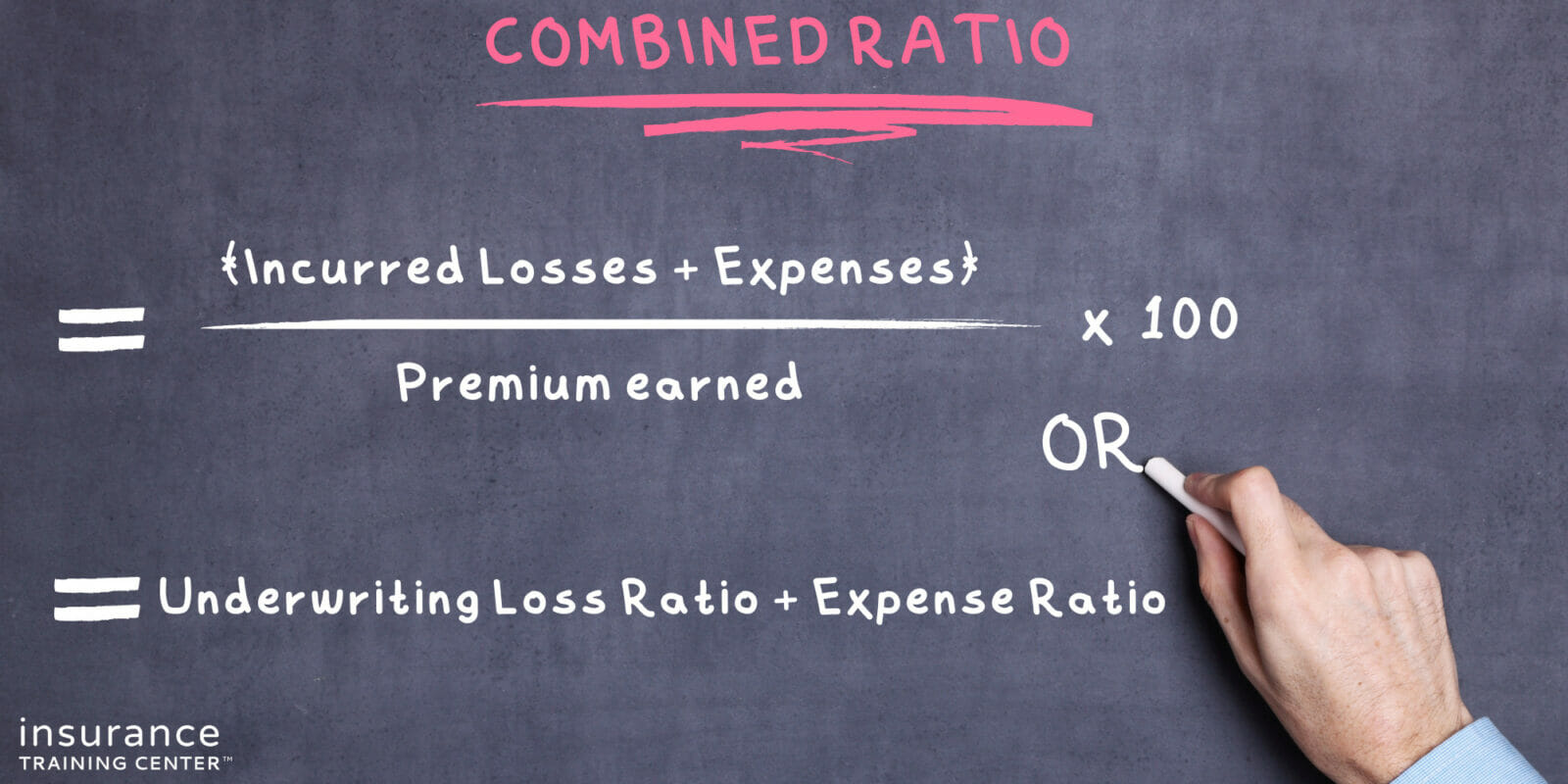

Understanding Combined Ratio Insurance Training Center

How Do You Calculate Loss Ratio In Insurance What is an acceptable loss ratio? it is calculated as the ratio of incurred losses (including claims paid, loss reserves, and loss adjustment expenses) to the earned. the formula to calculate the insurance loss ratio (ilr) is straightforward and is given by: How do you calculate a loss ratio? the loss ratio is calculated as losses incurred in claims (paid to the insured for damages when the risk event happens) plus adjustment expenses. it is a metric that specifically measures the profitability of insurance companies. \ [ ilr = \frac {d} {p} \times. What is an acceptable loss ratio? Loss ratio is an important metric. the loss ratio should be used in conjunction with the expense ratio to determine the company’s profitability. with this loss ratio calculator, we are here to help you calculate and insurance company's underwriting loss ratio. Loss ratio = ((insurance claims paid + loss adjustment. by using the formula for loss ratio calculation, insurance companies can gain insights into their financial performance, identify.

From www.einsurance.com

Loss Ratio and Combined Ratio What You Should Know EINSURANCE How Do You Calculate Loss Ratio In Insurance the loss ratio is calculated as losses incurred in claims (paid to the insured for damages when the risk event happens) plus adjustment expenses. with this loss ratio calculator, we are here to help you calculate and insurance company's underwriting loss ratio. How do you calculate a loss ratio? What is an acceptable loss ratio? it is. How Do You Calculate Loss Ratio In Insurance.

From bizfluent.com

How to Calculate Loss Ratio in Insurance Bizfluent How Do You Calculate Loss Ratio In Insurance the loss ratio is calculated as losses incurred in claims (paid to the insured for damages when the risk event happens) plus adjustment expenses. it is calculated as the ratio of incurred losses (including claims paid, loss reserves, and loss adjustment expenses) to the earned. Loss ratio is an important metric. it is a metric that specifically. How Do You Calculate Loss Ratio In Insurance.

From www.slideserve.com

PPT Nonlife insurance mathematics PowerPoint Presentation, free How Do You Calculate Loss Ratio In Insurance Loss ratio = ((insurance claims paid + loss adjustment. with this loss ratio calculator, we are here to help you calculate and insurance company's underwriting loss ratio. it is a metric that specifically measures the profitability of insurance companies. by using the formula for loss ratio calculation, insurance companies can gain insights into their financial performance, identify.. How Do You Calculate Loss Ratio In Insurance.

From insurancetrainingcenter.com

Understanding Combined Ratio Insurance Training Center How Do You Calculate Loss Ratio In Insurance it is calculated as the ratio of incurred losses (including claims paid, loss reserves, and loss adjustment expenses) to the earned. by using the formula for loss ratio calculation, insurance companies can gain insights into their financial performance, identify. How do you calculate a loss ratio? it is a metric that specifically measures the profitability of insurance. How Do You Calculate Loss Ratio In Insurance.

From insurancetrainingcenter.com

Understanding Loss Ratio Insurance Training Center How Do You Calculate Loss Ratio In Insurance the loss ratio should be used in conjunction with the expense ratio to determine the company’s profitability. by using the formula for loss ratio calculation, insurance companies can gain insights into their financial performance, identify. it is a metric that specifically measures the profitability of insurance companies. Loss ratio is an important metric. the formula to. How Do You Calculate Loss Ratio In Insurance.

From www.ebwllc.com

What to Know About Medical Loss Ratios EBW Financial Planning How Do You Calculate Loss Ratio In Insurance the formula to calculate the insurance loss ratio (ilr) is straightforward and is given by: Loss ratio is an important metric. the loss ratio should be used in conjunction with the expense ratio to determine the company’s profitability. by using the formula for loss ratio calculation, insurance companies can gain insights into their financial performance, identify. . How Do You Calculate Loss Ratio In Insurance.

From www.slideserve.com

PPT Finance 431 PropertyLiability Insurance Lecture 7 Loss How Do You Calculate Loss Ratio In Insurance with this loss ratio calculator, we are here to help you calculate and insurance company's underwriting loss ratio. How do you calculate a loss ratio? Loss ratio is an important metric. it is a metric that specifically measures the profitability of insurance companies. by using the formula for loss ratio calculation, insurance companies can gain insights into. How Do You Calculate Loss Ratio In Insurance.

From livewell.com

How To Calculate Loss Ratio Insurance LiveWell How Do You Calculate Loss Ratio In Insurance with this loss ratio calculator, we are here to help you calculate and insurance company's underwriting loss ratio. Loss ratio = ((insurance claims paid + loss adjustment. Loss ratio is an important metric. How do you calculate a loss ratio? it is calculated as the ratio of incurred losses (including claims paid, loss reserves, and loss adjustment expenses). How Do You Calculate Loss Ratio In Insurance.

From www.omnicalculator.com

Loss Ratio Calculator for Insurance Companies How Do You Calculate Loss Ratio In Insurance the loss ratio should be used in conjunction with the expense ratio to determine the company’s profitability. it is a metric that specifically measures the profitability of insurance companies. the formula to calculate the insurance loss ratio (ilr) is straightforward and is given by: with this loss ratio calculator, we are here to help you calculate. How Do You Calculate Loss Ratio In Insurance.

From www.wikihow.com

How to Calculate Quick Ratio 8 Steps (with Pictures) wikiHow How Do You Calculate Loss Ratio In Insurance the formula to calculate the insurance loss ratio (ilr) is straightforward and is given by: by using the formula for loss ratio calculation, insurance companies can gain insights into their financial performance, identify. Loss ratio is an important metric. \ [ ilr = \frac {d} {p} \times. with this loss ratio calculator, we are here to help. How Do You Calculate Loss Ratio In Insurance.

From www.youtube.com

Explaining Health Insurance Medical Loss Ratio YouTube How Do You Calculate Loss Ratio In Insurance \ [ ilr = \frac {d} {p} \times. the loss ratio should be used in conjunction with the expense ratio to determine the company’s profitability. How do you calculate a loss ratio? by using the formula for loss ratio calculation, insurance companies can gain insights into their financial performance, identify. Loss ratio is an important metric. Loss ratio. How Do You Calculate Loss Ratio In Insurance.

From www.peoplekeep.com

Fiveminute guide to medical loss ratios (MLRs) How Do You Calculate Loss Ratio In Insurance What is an acceptable loss ratio? How do you calculate a loss ratio? Loss ratio = ((insurance claims paid + loss adjustment. Loss ratio is an important metric. with this loss ratio calculator, we are here to help you calculate and insurance company's underwriting loss ratio. the loss ratio should be used in conjunction with the expense ratio. How Do You Calculate Loss Ratio In Insurance.

From www.kff.org

Explaining Health Care Reform Medical Loss Ratio (MLR) KFF How Do You Calculate Loss Ratio In Insurance with this loss ratio calculator, we are here to help you calculate and insurance company's underwriting loss ratio. Loss ratio is an important metric. What is an acceptable loss ratio? it is a metric that specifically measures the profitability of insurance companies. the loss ratio should be used in conjunction with the expense ratio to determine the. How Do You Calculate Loss Ratio In Insurance.

From www.youtube.com

Loss Ratio In Insurance Insurance Terminologies YouTube How Do You Calculate Loss Ratio In Insurance it is a metric that specifically measures the profitability of insurance companies. How do you calculate a loss ratio? the loss ratio should be used in conjunction with the expense ratio to determine the company’s profitability. it is calculated as the ratio of incurred losses (including claims paid, loss reserves, and loss adjustment expenses) to the earned.. How Do You Calculate Loss Ratio In Insurance.

From hilmaninsurance.blogspot.com

What Is Combined Ratio Components and Formula? HILMAN INSURANCE How Do You Calculate Loss Ratio In Insurance Loss ratio = ((insurance claims paid + loss adjustment. How do you calculate a loss ratio? Loss ratio is an important metric. the formula to calculate the insurance loss ratio (ilr) is straightforward and is given by: What is an acceptable loss ratio? it is a metric that specifically measures the profitability of insurance companies. by using. How Do You Calculate Loss Ratio In Insurance.

From www.slideserve.com

PPT Financial Ratios PowerPoint Presentation, free download ID1003664 How Do You Calculate Loss Ratio In Insurance Loss ratio = ((insurance claims paid + loss adjustment. Loss ratio is an important metric. the loss ratio should be used in conjunction with the expense ratio to determine the company’s profitability. the formula to calculate the insurance loss ratio (ilr) is straightforward and is given by: How do you calculate a loss ratio? it is a. How Do You Calculate Loss Ratio In Insurance.

From www.insurancebusinessmag.com

Insurance companies with the most profitable loss to EP ratios How Do You Calculate Loss Ratio In Insurance Loss ratio is an important metric. it is a metric that specifically measures the profitability of insurance companies. Loss ratio = ((insurance claims paid + loss adjustment. What is an acceptable loss ratio? the loss ratio should be used in conjunction with the expense ratio to determine the company’s profitability. with this loss ratio calculator, we are. How Do You Calculate Loss Ratio In Insurance.

From www.youtube.com

Insurance Loss Ratio What is it and Why it Matters For your Business How Do You Calculate Loss Ratio In Insurance How do you calculate a loss ratio? What is an acceptable loss ratio? Loss ratio = ((insurance claims paid + loss adjustment. with this loss ratio calculator, we are here to help you calculate and insurance company's underwriting loss ratio. it is calculated as the ratio of incurred losses (including claims paid, loss reserves, and loss adjustment expenses). How Do You Calculate Loss Ratio In Insurance.